BE 2018 YEAR OF ASSESSMENT FormLEMBAGA HASIL DALAM NEGERI MALAYSIA CP4B Pin. A resident company incorporated in Malaysia with an ordinary paid-up share capital of RM25 million and belowor 2.

INLAND REVENUE BOARD OF MALAYSIA INDUSTRIAL BUILDINGS Public Ruling No.

. 2 May 2018 52 Subject to paragraph 35 and 51 c of this PR t he areas of expertise to be considered for the REP ar e the fieldsindustries recognis ed under. The Commercial Code in Malaysia is based on the Civil Law and additional laws that provide for the functioning of the business and commercial climate in the countryPolitical and economic developments in the region have offered an opportunity to revise and improve the legislation for doing business in MalaysiaThe commercial law is largely based on the English commercial. 01271 Growing of coffee 01272 Growing of tea 01273 Growing of cocoa 01279 Growing of other beverage crops nec.

20182019 Malaysian Tax Booklet. It also incorporates the 2018 Malaysian Budget proposals announced on 27 October 2017. 01281 Growing of pepper piper nigrum.

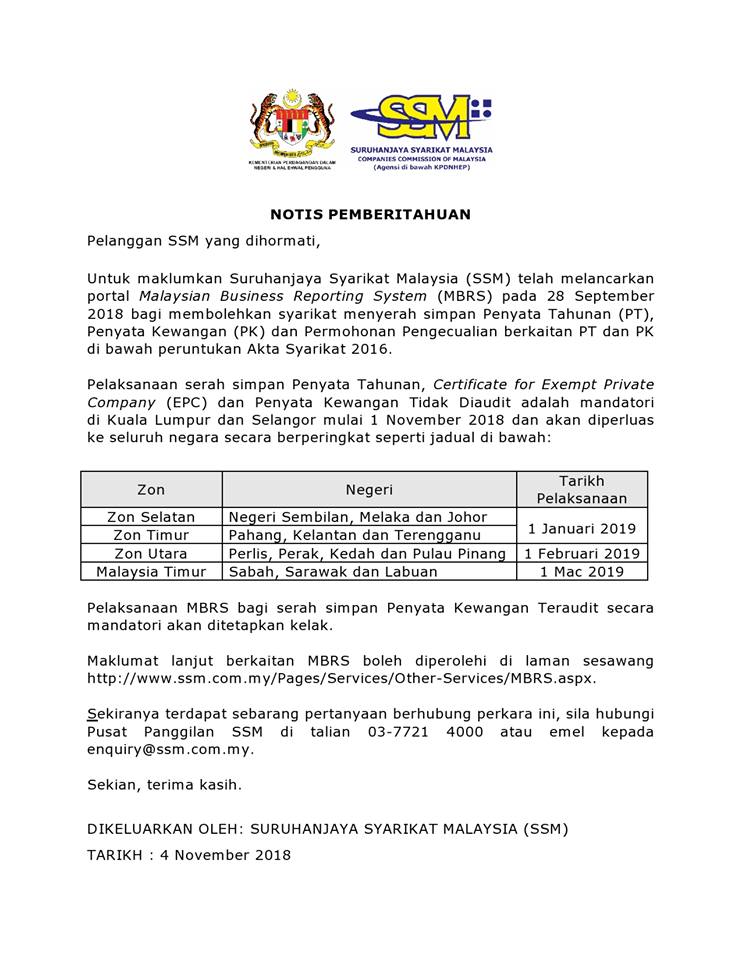

Bahagian Strategi Komunikasi Korporat. June 2018 is the FY ending 30 June 2018. This guide covers everything you need to know about Sales and Service Tax in Malaysia as a small business owner.

Identification passport no. 20172018 Malaysian Tax Booklet. All income of persons other than a company limited liability partnership co-operative or trust body are assessed on a calendar year basis.

33500 Electrical equipment appliances and. This Guide offers help to those interested in doing business in Malaysia. Malaysia has over the last 60 years developed from a primary commodities exporter to become an attractive regional hub for services.

Ii Return of Particulars of Directors Managers and Secretaries Form 49 Notice Section 58 1 copy. I Certificate of Incorporation Form 9 Notice Section 17 1 copy. 2 01262 Growing of oil palm smallholdings 01263 Growing of coconut estate and smallholdings 01269 Growing of other oleaginous fruits nec.

Search by MSIC 2008 Code Please insert at least 3 digits. Code 110000 Agriculture forestry hunting and fishing 111000 Crop production Mining Code 211110 Oil and gas extraction 211120 Crude petroleum extraction 211130 Natural gas extraction 212000 Mining except oil and gas Utilities Code 221000 Utilities Construction Code 230000 Construction 236000 Construction of buildings Manufacturing Code 310000 Manufacturing. It incorporates key proposals from the 2019 Malaysian Budget.

The Malaysia Standard Industrial Classification MSIC search engine system or e-MISC was developed to facilitate the users to find the relevant industrial code. For little and medium venture SME the main RM500000 Chargeable Income will be impose at 18 and the Chargeable Income above RM500000 will be assess at 24. Iv Any one Directors NRIC Passport as stated in Form 49 Notice Section.

The material contained in this Guide is based on legislation as at 31 March 2018 unless otherwise indicated. 82016 Date Of Publication. 22018 INLAND REVENUE BOARD OF MALAYSIA Date of Publication.

Kawal Selia Penguatkuasaan. Delete whichever is not. Malaysia adopts a self-assessment system which means that the responsibility to determine the correct tax liability lies with the taxpayer.

Corporate companies are taxed at the rate of 24. In Budget 2017 it is suggested that decrease of expense rate for increment in chargeable wage will apply for YA 2017 and 2018. LAWS OF MALAYSIA Act 807 SERVICE TAX ACT 2018 ARRANGEMENT OF SECTIONS Part I PRELIMINARY Section 1.

To be a public servant within the meaning of the Penal Code Act 574. Monitorcorporategovernancedevelopmentsandassisttheboard in applying governance practices to meet the boards needs and stakeholdersexpectationsand Serveasafocalpointforstakeholderscommunicationandengagement on corporate governance. The landmass of Malaysia comprises Peninsula Malaysia at the south eastern tip of the Asian mainland and East Malaysia on the island of.

This publication is a quick reference guide outlining Malaysian tax information which is based on taxation laws and current practice. Short title and commencement. 2018 RETURN FORM OF A INDIVIDUAL RESIDENT WHO DOES NOT CARRY ON BUSINESS UNDER SECTION 77 OF THE INCOME TAX ACT 1967 This form is prescribed under section 152 of the Income Tax Act 1967 ame.

33311 Agricultural machinery and equipment manufacturing. MALAYSIAN CODE ON CORPORATE GOVERNANCE. 33312 Construction machinery manufacturing.

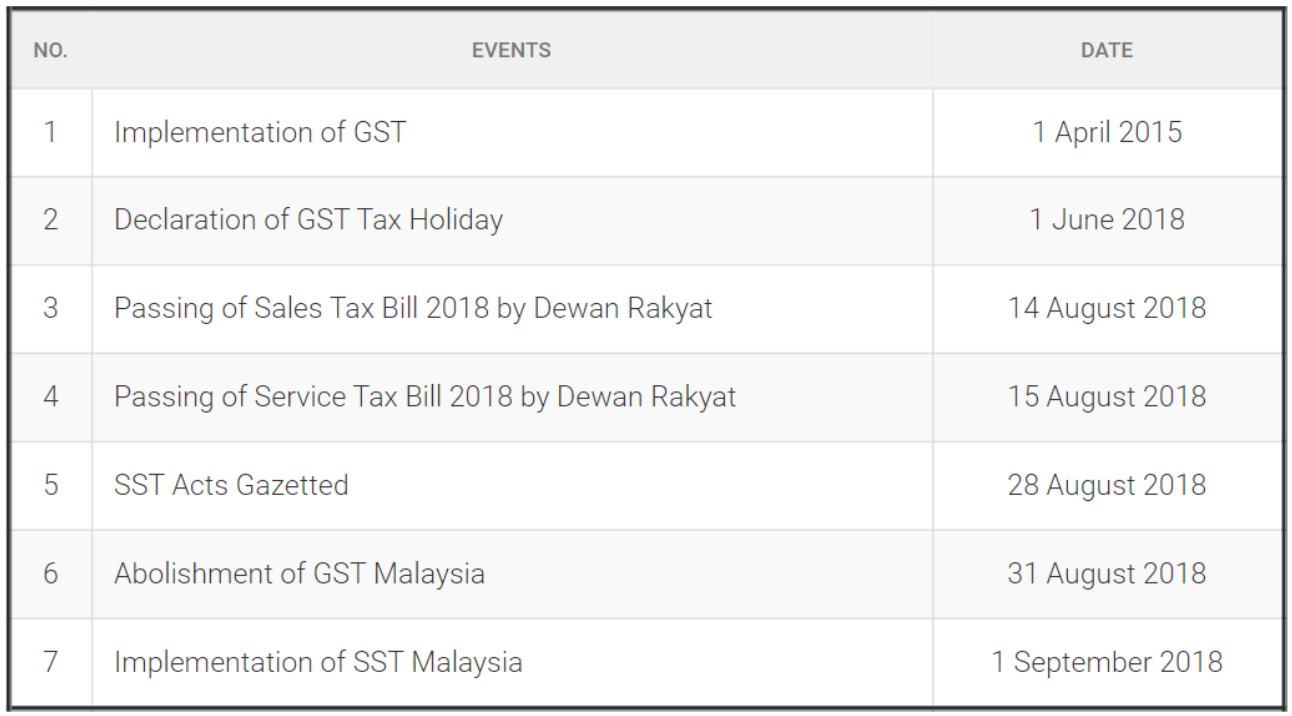

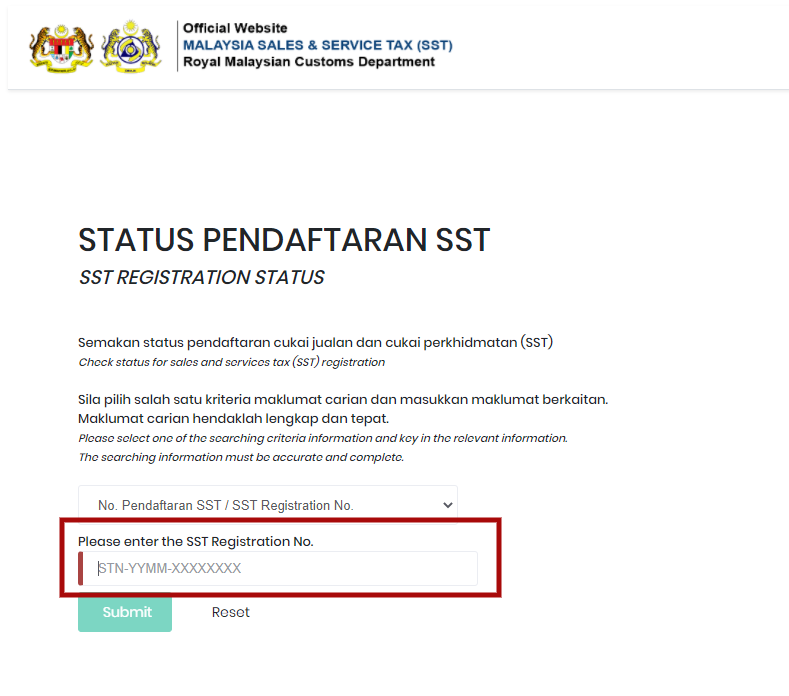

In Malaysia Sales and Service Tax SST was officially re-introduced on 1 September 2018 replacing the former three-year-old Goods and Services Tax GST system. Pendaftaran Perniagaan ROB ezBiz Online. Whose principal place of business located in Malaysia 51.

Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber 8 63000 Cyberjaya Selangor. 33332 Commercial service industry temperature control and airflow control machinery manufacturing. SSM MSIC 2008 CODE - ROC No Business Code Description Malay Description English 36 01137i Import ubi gula Import of sugar beet 37 01137u Eksport dan Import ubi gula Export and Import of sugar beet 38 01138e Eksport tumbuhan berakar ubi-ubian bebawang atau sayur-sayuran berubi Export of roots tubers bulb or tuberous vegetables.

8 DOING BUSINESS GUIDE Location and climate Malaysia is situated in Southeast Asia in the area bordered by longitudes 100 degrees and 120 degrees east and latitudes formed by the equator and 7 degrees north. Even though SST is not the same as GST in various aspects there are still many similarities. The MSIC 2008 version 10 is an update of industry classification developed based on the International Standard of Industrial Classification of All Economic Activities ISIC Revision 4.

A Limited Liability Partnership LLP resident in Malaysia with. Power of Minister to impose service tax. This publication is a quick reference guide outlining Malaysian tax information which is based on taxation laws and current practice.

Budget 2019 Finance Bill 2018 Income Tax Amendment Bill 2018 and Labuan Business Activity Tax Amendment Bill 2018 Tax Espresso Special Edition. Seksyen Integriti Disiplin. 23 November 2016 Page 3 of 14 iii A workshop us ed for the repair or servicing of goods provided that the repair or servicing is not carried out in conjunction with or incidental to the business of selling those goods.

A1 Citizen Use country code Enter MY if Malaysian citizen A2 Gender 1 Male 2 Female A3 ddmmyyyyDate of birth A4 Status as at 31 -12 2018 1 Single 3 Divorcee widow widower 2 Married 4 Deceased A5 Date of marriage divorce demise ddmmyyyy A6 Record-keeping 1 Yes 2 No. Iii Photos of your business premise front and interior of premise.

Ssm Company Name Search Online Check Name Availability Name Search With Ssm

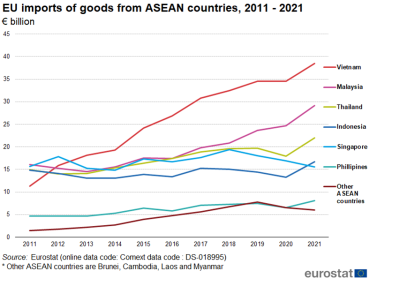

Asean Eu International Trade In Goods Statistics Statistics Explained

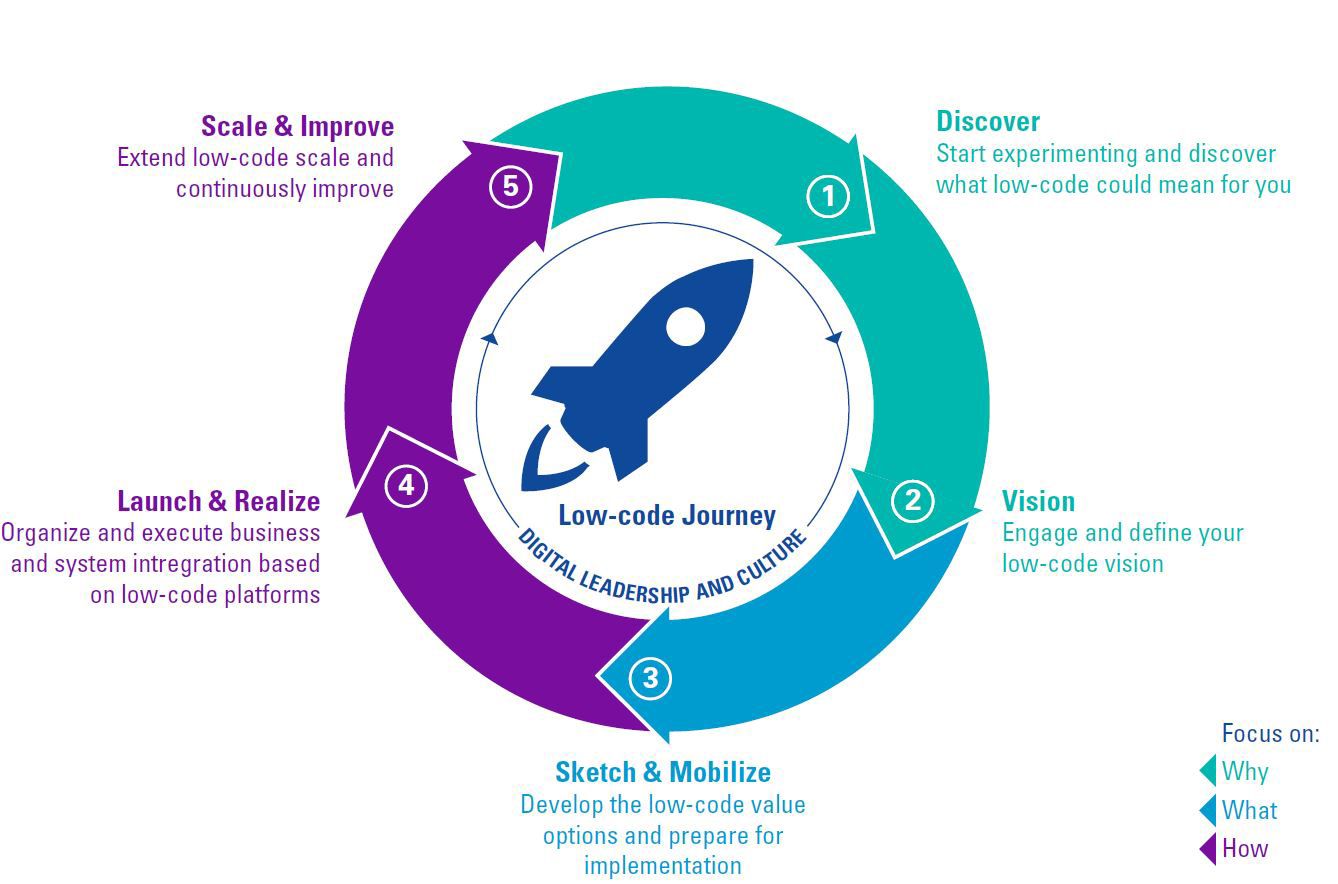

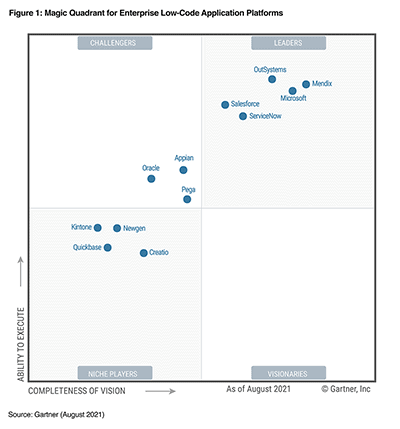

Low Code Services Kpmg Netherlands

Business Activity Code For Taxes Fundsnet

Sdg 8 Decent Work And Economic Growth Statistics Explained

Malaysia Sst Sales And Service Tax A Complete Guide

Malaysia Sst Sales And Service Tax A Complete Guide

Asean Eu International Trade In Goods Statistics Statistics Explained

Gartner Magic Quadrant For Enterprise Low Code Application Platforms 2021

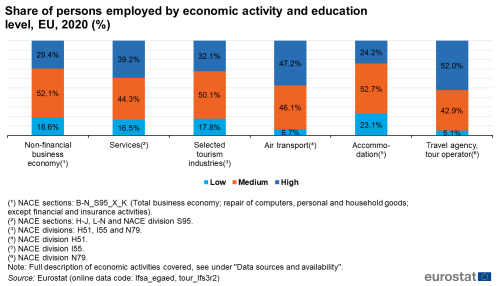

Tourism Industries Employment Statistics Explained

Msc Business Information Management Rotterdam School Of Management Erasmus University

Weekend Flash Discount Sale Oman Air With Ambassador Travels Call Us For Know More 974 55003230 44414120 Www Ambt Business Class Travel Casablanca

Asean Eu International Trade In Goods Statistics Statistics Explained

Business Card Template Vector Business Card Template Design Modern Business Cards Business Card Template

Code Of Business Conduct The Heineken Company

Olympique De Marseille L Om Puma Football Club 2018 19 Training Casual Top Tracksuit Zipper Futbol Calcio Soccer Fussb Tracksuit Mens Sweatshirts Casual Tops